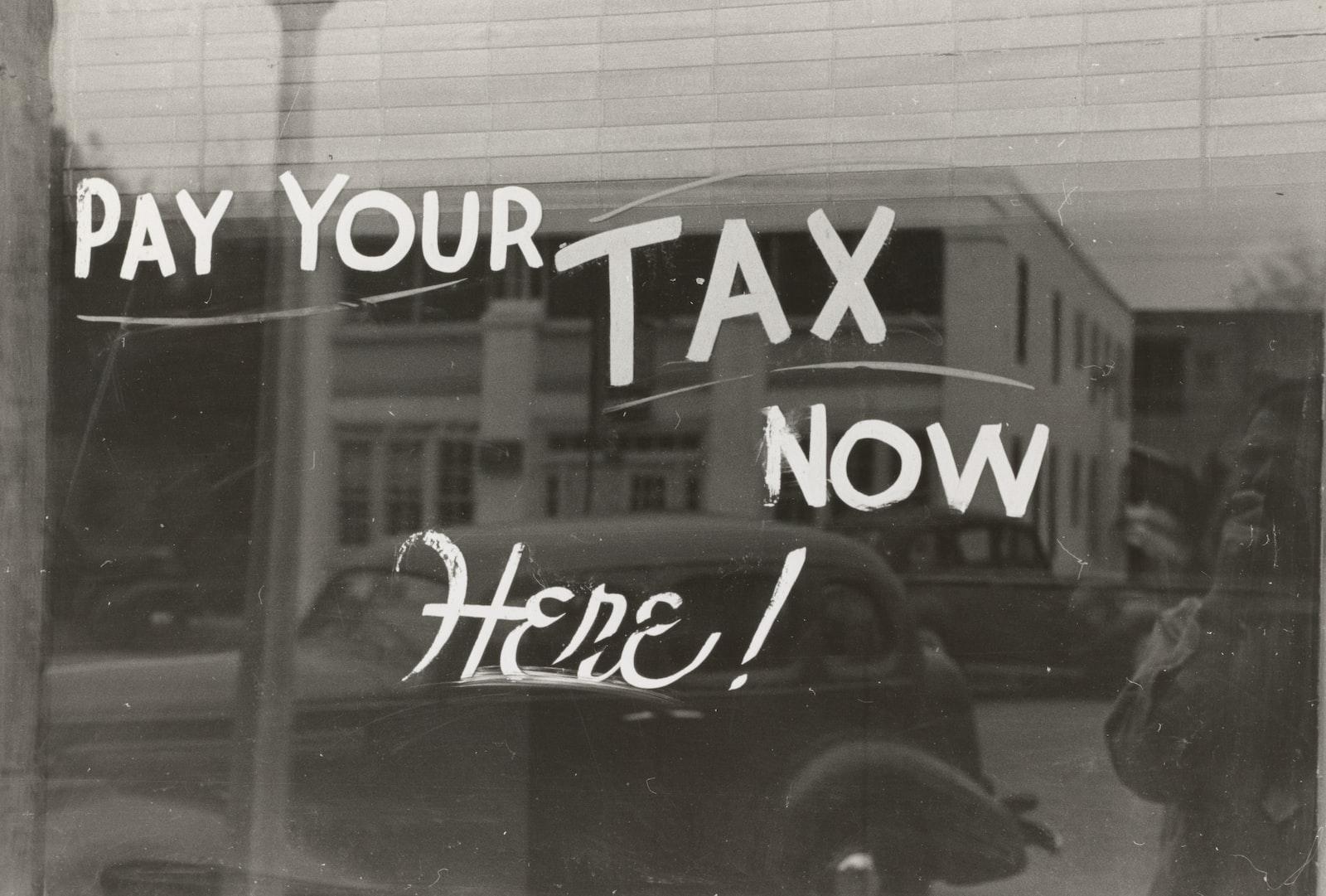

Is your tax bill growing faster than your NOI?

We have had some unprecedented things happen in the real estate market between 2020 and 2022. In January 2020 we hosted the CIASF annual Industrial Market Report and presented data on the state of the industrial sales and leases in 2019. The consensus was purely positive. But then… March rolled around and COVID-19 shutdown the world. A black swan event that no one could’ve planned for. With the world supply chains grinding to a halt and cities around the globe instituting isolation protocols, no one knew what would become of offices, retail shops and industrial buildings and really the entire range of the economy.

The Fed swooped in to keep the monetary system moving and added nearly 4.5 trillion dollars to their balance sheet between 2020 and 2022. Pretty much any asset priced in dollars bounced back within a few months. But they kept the printing machine going, and only just this spring began to cut back on the Quantitative Easing, that really began in 2009 but when full force in 2020.

As things opened back up, instead of everything returning to where we were, we had a rapid increase in demand for industrial and housing.

All this easy money and new demand created rapid growth in the stock market between 2020 and 2022. And along with it, so did sales prices of all types of real estate in South Florida.

Now guess what happens when sales prices go up in Florida? The Property Appraiser office hears all about it, and they start taking this all into account when feeding data into their Computer Assisted Mass Appraisal (CAMA) system.

They can put off raises to taxable values only so long, but with the record-breaking headlines hitting The Real Deal and The Miami Business Journal each week and especially so in 2022 (even as the stock market began to falter and drop into bear market territory) it was hard to keep back the raises.

Here we are at tax time, with CPI readings from hitting highs not seen since The 80s and the costs for repairs and materials, insurance, and other unavoidable expenses rising 10-20% per year the last two years.

Expenses outpacing the ability to raise rental rates?

If you found out that on top of these rising costs your real estate bill, typically the single largest expense for a landlord in Florida (we have no income tax to help fund the government) is also going up 20% what would that do to your returns?

Despite the headlines blaming landlords for predatory rents increases across the county, real estate is a balancing act of a business, either the rents increase to cover the increase in costs or cash flows decline so much that the value someone is willing to pay for an asset drops, possibly dragging a much larger chunk of the economy with it.

But not everyone is willing or able to raise rates to keep pace with their in increasing expenses.

Some landlords are locked into long term leases or situations where their ability or desire to continually chase higher rental rates can’t keep up with costs. If you’re in this predicament and your tax bill is out pacing your NOI growth, contact us before September 15th to help.

Dixon Commercial Real Estate has, for over 20 years, provided real estate tax appeal services in Miami-Dade County and knows all the best angles to at least keep your taxable values in line with your property’s ability to provide cash flows. We have saved owners thousands of dollars each year and can do the same for you. We handle all types of property, commercial, residential and vacant land, sign up now before the deadline passes.

You check your current assessed values at the Miami-Dade Property Appraiser website now, and the estimated taxes by clicking the TRIM Notice in the Online Tools section.

Unfortunately, there’s nothing we can to do to lower the cost of your landscaper, repairman, insurance premium or rising borrowing costs.